7 trends that will redefine the print industry in 2019

By Louella Fernandes on December 3, 2018

Articles, Artificial Intelligence, Channel, Digital Transformation, Managed Print Services, Trends

2018 saw the print industry continue to face the stark realities of digital disruption. While HP continues to strengthen its lead in an increasingly commoditised market, the traditional copier companies such as Konica Minolta, Ricoh and Xerox continue to take differing approaches to retain relevance. Konica Minolta is banking on its Workplace Hub pro platform to extend its IT services reach in the SMB market; Ricoh is maintaining focus on a broad range of print, workplace and IT services, while Xerox is driving its connected MFP business (under the cloud of recent merger troubles). Whatever the outcome, the industry must continue to embrace the following trends that will define success or failure in 2019.

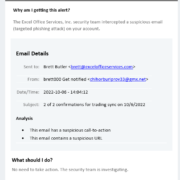

1. IoT momentum will fuel print security spend

IoT-type security vulnerabilities on printers will become a more common attack vector as cyber-attacks that exploit IoT devices show no sign of abating. Protecting today’s print environment is challenging due to its complexity, particularly with mixed fleets compromising outdated old and new devices. GDPR has driven some improvements in print security, but there is still some lack of awareness of the potential IoT security risks around printers and smart MFPs.

Attackers are not only seeking the confidential information that gets stored on print devices, but also to use them as network access points in the same way as other IoT-type devices are being abused. As more MPS providers patch, maintain and manage print devices through the cloud, security will become paramount. Automated, cloud-delivered, patch management ensures that discovered vulnerabilities, which vendors are most likely to know about first, are fixed as soon as possible.

Print manufacturers need to expand their security assessment and monitoring services, along with partnering with traditional IT security vendors, particularly in the area of threat intelligence. This will be imperative to ensure that print security is treated with the same priority as the rest of the IT infrastructure. Although HP has put a stake in the ground when it comes to print security, 2019 will see competitors, particularly the managed print service (MPS) providers, expand their print security products and services.

2. Continued print and digital convergence

Print and digital convergence will drive increased demand for integrated document workflow in 2019.

Despite the rapid adoption of digital and mobile technologies, many businesses remain reliant on print to some extent. Quocirca’s Global Print 2025 study revealed that 64% of businesses believe that printing will remain important to their daily business even by 2025. This is partly due to an ongoing need for physical signatures, and receipt of paper communications from suppliers, along with the preferences of customers and employees. All this is a significant opportunity for MPS providers to articulate a clear proposition around integrated paper and digital workflow services.

Xerox has taken a lead here with its ConnectKey platform and, if it can drive engagement with its channel to develop workflow apps that help bridge the paper to digital divide, it will help businesses make better use of existing Smart MFP investments. As businesses look for guidance with digital initiatives, MPS providers that have the digital workflow skills to drive efficiency and productivity improvements, will be best positioned to succeed.

3. Cloud MPS comes of age

Cloud-delivered MPS will become more prominent, reducing the burdens associated with managing print. Managing print on-premise is expensive. For example, moving management to the cloud enables print jobs to be submitted to a virtual print server, rather than multiple on-premise servers. A few vendors have already made steps in this direction such as Lexmark, Ricoh and Xerox, along with Y Soft who recently announced cloud-based print services. Lexmark’s cloud service offers a hybrid option that ensures print jobs are kept inside the firewall, providing customers the efficiency of cloud services while minimising security concerns.

Cloud services offer channel partners, looking to improve profitability and deepen customer relationships, a flexible and low-cost approach to MPS and access to the SMB market. 2019 will undoubtedly see more MPS providers extend their traditional offerings to the Cloud.

4. The big data opportunity will remain unexploited

The promise of big data analytics will not deliver in the short term.

Although the big-data opportunity has enormous potential for the print industry, most manufacturers have yet to capitalise on this. While some leading MPS vendors do use analytics to optimise printing practices, by understanding what is printed or scanned by whom and where, this could be taken to a new level.

Manufacturers could use all this data to gain customer insights and market and deliver new services. However, print management analytics tools are often not designed for the big-data analysis required, and many MPS providers lack the necessary business intelligence analysis skills.

Exploiting big data and predictive analytics will demand new expertise and competencies. This will need to be built through a big-data talent acquisition strategy, driven either organically or through new collaborative partnerships. One vendor that is already making strides in this space is Ricoh, which already offers comprehensive analytics services to help design smart workplaces, that incorporate additional collaboration and communication services such as virtual meeting rooms, interactive whiteboards and video conferencing.

5. IT services expertise will be key

Quocirca’s Print 2025 research revealed that businesses will favour IT service providers over traditional print suppliers by 2025. Channel partners must expand their IT expertise either organically or by partnering with experienced IT service providers, providing access to a broader product portfolio, for example, offering print security as part of an overall managed security service offering. For manufacturers or large channel organisations, acquiring IT providers can be an effective means of gaining the specialised sales and support expertise required. Some manufacturers including Kyocera, Konica Minolta, Ricoh and Sharp have already made the shift, expanding their managed IT service capabilities largely through acquisition; more activity can be expected in 2019.

6. Leading players will offer managed IoT services

MPS providers have a strong legacy in managing the most established IoT-type devices on the network – printers and multifunction printers (MFPs). Effective MPS platforms already drive the performance, reliability, security and continuity of the print infrastructure through device monitoring, analytics, remote diagnostics and predictive maintenance. The emergence of enterprise IoT platforms offering asset management, fault detection, smart analytics and remote monitoring presents a broader opportunity for MPS providers to participate in the IoT space. This opportunity is not limited to traditional IT endpoint devices but could also encompass intelligent workplace and smart building assets such as thermostats, lighting and video cameras.

As enterprise IoT gathers pace, MPS providers should evaluate opportunities to integrate their technology with enterprise IoT platforms. Although managed IoT services offer a breadth of opportunities, providers also need to consider the security challenges. While most MPS providers offer robust security to protect print devices from external hacking and to prevent exposure of confidential information, the management of new IoT devices requires new competencies to identify and monitor device vulnerabilities. Collaborating and partnering with third-party providers to gain expertise in IoT device management and security is therefore the best way forward for looking to extend capabilities.

7. AI enters the workplace

Smart workplace technology services will start leveraging artificial intelligence.

2018 saw some rudimentary voice recognition capabilities emerge for smart printers and MFPs. We can expect to see enhancements of these in 2019. HP and Xerox have both developed capabilities. Momentum will largely depend on partnerships with companies like Google and Amazon, for example with the use of the latter’s Alexa for Business. For traditional print manufacturers, who need to be more relevant in the future workplace, developing capabilities in this area will be key.

Over the next year the print industry continue its reinvention, requiring that manufacturers and their partners drive relevance, not only through compelling print and digital workflow offerings but also by offering services that are more relevant to the smart workplace. Digital transformation will continue to be high on the agenda of most businesses, and this will remain an opportunity for industry players to position their products and services as a means of helping businesses drive efficiency. Printing in the workplace may be gradually diminishing, but it is not disappearing and suppliers that are best positioned to succeed will be those that extend their offerings and software competencies to serve broader IT requirements as the print and digital worlds become ever more closely intertwined.